Vice President of the world’s leading seismic company, TGS, in charge of Africa, Mediterranean & Middle East Regions, Mr Will Bradbury, is hoping oil producing countries that are planning to launch licensing bid round for their oil blocks can set clear timelines in order to attract investors.

He believes that if timelines are clearly stated with specifics as to how oil companies can acquire acreages, it will help prospective companies, which intend to bid for oil block, to decide and plan ahead.

Mr Bradbury further stated that “this will also help to reduce the risk associated with oil exploration”.

He gave the advice in an exclusive interview with energynewsafrica.com via telephone on a wide range of issues regarding the upstream industry.

.

Decline in data investments

Records available indicate that investments in seismic data declined from $8.86billion in 2013 to $3.8billion in 2017, representing about 60% decrease in seismic investments globally.

Speaking to the issue, Mr Bradbury said the decline can certainly be attributed to the fall in oil price within that period.

“The oil price dropped drastically and that had an impact on investment. What we saw is that there was cut in exploration budget by most oil companies,” he explained.

He was, however, optimistic that investment in seismic data would pick up going forward, given the current trend.

This, in his estimation, is as a result of upcoming licensing bid round in some oil producing countries.

Projects

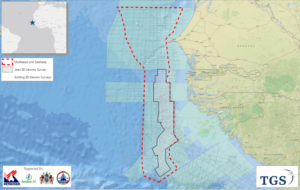

Currently, TGS has acquired 3D seismic data and multi-beam which cover Senegal, Gambia and Guinea. TGS is also reprocessing some existing data for Ghana, Nigeria, Togo and Benin.

TGS is also reprocessing some existing data for Ghana, Nigeria, Togo and Benin.

Asked which area he expects oil growth to come, he mentioned West Africa and Latin America.

Will Bradbury, who said the oil and gas sector in Africa has a bright future, noted that Africa is in competition with South America and underscored the need for African countries to do things that would entice investors.

Regulatory regime

Touching on the regulatory environment in Africa, Mr Bradbury said there has been transparency, honesty and openness in all conversations and discussions.

“We try and do open conversation. We have good discussions,” he said.