By: Paa Kwasi Anamua Sakyi, IES

Oil has become the world’s most important source of energy since the mid-1950s, with nearly one third of global energy consumption. Its use is a necessary part of the modern world, and prices have a big impact on prices of petroleum products, oil exploration and exploitation activities; and on global markets and economies.

The high volatility of oil prices exist because many different players like world leaders, cartels, speculators and global investors seek to influence price on daily basis. Through commodities and financial market happenings, geopolitical events, infrastructure constraints, speculation, regulations, policies, alternative fuel sources, arm conflicts, natural and man-made disasters, and technologies; supply and demand of crude oil is influenced.

The dynamic and complexed movements between these factors ends in the strange performance of the crude oil price movement. For instance, between 2000 and 2008, oil witnessed an unprecedented surge in price, from around US$25 per barrel to nearly US$150 per barrel due to increasing demand in emerging economies like China and India, with production cuts by the Organization of Petroleum Exporting Countries (OPEC) driving price to its record heights. The great oil bust of 2014 where in a matter of six months, Brent oil price dropped over 40 percent from US$115 per barrel to US$70 per barrel, and tumbled to mid-$20s of a barrel in first month 2016, is yet another typical example.

Recent Supply Concerns

Crude oil prices were volatile after an attack on Saudi Arabia’s oil infrastructure facilities on September 14th 2019, shutting 5 percent of global crude output and spiking the most since the 1991 Gulf war. Global benchmark Brent crude oil rose 19 percent to almost US$72 per barrel after the market opened for the first time after the drone strike at the heart of Saudi Arabia’s oil industry.

In spite of the assurances given by Saudi Arabia to swiftly repair the damaged facilities and recover from the recent attack on its oil infrastructure, the market was doubtful given that the Houthi/Iran alliance has demonstrated that it can hit the Saudi’s oil and gas industry at will. With Military assessments also suggesting that similar attacks are fundamentally difficult to protect against, the market very much appreciates the long term effect of the attacks.

The record surge in Brent crude futures on Monday only tells part of the story of how the oil market reacted to the attack that removed about 5 percent of global supplies. Brent futures soared as much as US$11.73 a barrel in intraday trading, the biggest increase since the contract launched in 1988. The global benchmark surged as much as 19.48 percent, the biggest jump since the first Gulf War in 1991.

The market expected the price surge in crude to filter through to gas stations, which it did. It was reported that the average U.S. retail Gasoline rose in price, even as futures on the New York Mercantile Exchange jumped as much as 20 cents on the back of the drone strikes.

In Ghana, concerns of fuel price hikes were largely discussed for days, following the huge crude price hike. The concerns were that following the attacks on critical oil facilities in Saudi Arabia, there would likely be a shortage of oil on the world market leading to further hike in crude prices, and automatic increase in the price of Gasoline and other refined products on both the world and local market. Other concerns were that an extended period of high oil prices is likely to lift the country’s annualized import bill, knowing quite well that the country imports almost all of the refined products it consumes; in spite of the fact that the country produces crude oil.

These concerns were expressed largely on the back of a 10 percent increase in transport fares, following hikes in prices of petroleum products from increased taxes a week earlier. The Road Transport Operators had announced the increment to cover intra-city transportation and inter-city or long distance travels, to accommodate predominantly the increase in local fuel prices.

Weathering Storms

Following the attack on Saudi Arabia’s oil facilities, there were concerns about how well China as the world’s top oil importer was positioned to weather higher oil prices and how will it affect its position in the ongoing trade war with the United States. To begin with, China’s level of oil imports has been steadily growing, from an already very high base, with last year seeing the country import 462 million metric tons of crude; a 10 percent increase over the previous year. At the same time as its basic economic demand for oil has increased, China has also sought to dramatically build up its strategic petroleum reserves through an increasing number of different channels, regardless of any – as it sees it – ‘short-term considerations’, such as U.S. sanctions on various countries.

India is another major oil consumer (importing over 80 percent of its oil requirement) that has positioned itself to manage any oil supply shocks; learning from the 1990–91 Gulf crisis that triggered a balance of payments crisis and left the country with oil reserves for just three days at one point. Today, India can survive for more than two months without importing oil. While India’s financial situation (with forex reserves of $430 billion) puts it in a much better position to deal with price spikes, it is the improved oil storage infrastructure that’s behind the limited insurance the country have in case of a supply crunch.

India’s refineries usually keep a stock to last for around 60 days. And to keep the flow of crude to refineries going in case of a supply disruption, India also has built a massive underground storage capacity for crude oil they called strategic petroleum reserves (SPRs). The oil in the three facilities already built can help meet 10 days of crude requirement and the two planned ones can hold supply of about 12 more days. The plan is to have crude oil storage capacity to last for 82 days.

Strategic Petroleum Reserves

Because the oil trading market is frost with uncertainty, price volatility, and sudden supply disruptions, many countries like United States, Japan, China, the United Kingdom (UK) and the European Union (EU) have found oil emergency stocks as a strategic mechanism to managing oil supply disturbances and price shocks.

It is on record that “it is the release of US’ oil stockpile as sanctioned by President Trump, that led to oil prices retreating after the Monday of the attack on Saudi’s oil facilities” and offering some level of stability in global oil supply.

Oil emergency stocks have been found as a strategic mechanism to managing oil supply disturbances and price shocks. In relation to oil supply, the threat may be defined as either a physical shortfall or a major change in prices. The two aspects are patently related, because a physical shortfall will inevitably lead to an increase in prices. It is in this light that members of the International Energy Agency (IEA) which has “energy security” as its core mandate, keep oil emergency stock for the purposes of reducing supply shortfalls and the attending economic harm.

The US Strategic Petroleum Reserve (SPR) established after the 1973/74 oil embargo, is the largest stockpile of government-owned emergency crude oil in the world, according to US Department of Energy (DoE). The intention is to provide the U.S. with a response option should a global supply disruption threaten the U.S. economy. It also allows the country to meet part of its IEA obligation to maintain emergency oil reserves.

The Missing Piece in Ghana

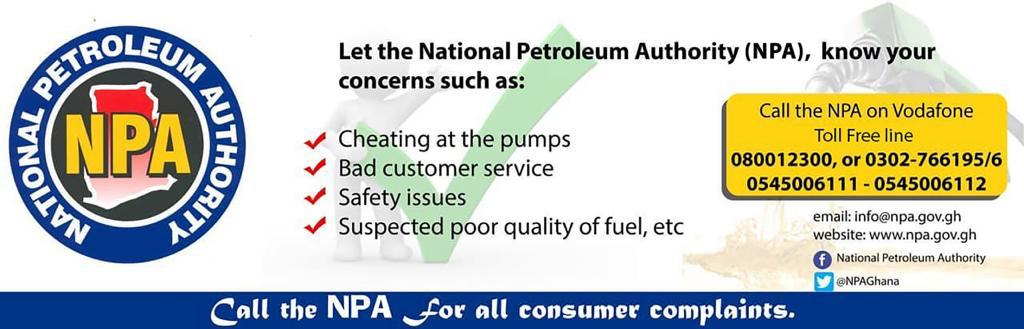

Fuel Consumers in Ghana have persistently been worried about global oil price volatility and paying more for Gasoline, Gasoil and liquefied petroleum gas (LPG) especially. They acknowledge that prices at the pump fluctuates depending largely on what’s happening globally and to some extent, happenings at home.

Following the Saudi attack, the concerns were that the country would automatically experience an increase in the price of Gasoline, Gasoil and LPG et cetera at the pump, and that should there be an extended period of high oil prices, the country’s annualized import bill will rise since almost every oil fuel consumed is imported, even though the country produces crude oil.

In spite of the many advantages in keeping Strategic Petroleum Reserve (SPR), Ghana has struggled to maintain the mechanism which have been given to the Bulk Oil Storage and Transportation Company Limited (BOST) as a mandate. Incorporated in 1993 as a private limited liability company with the government as the sole shareholder, BOST has the mandate to develop a network of storage tanks, pipelines and other bulk transportation infrastructure throughout the country, and to keep Strategic Reserve Stocks of fuel for Ghana.

For many years, the SPR role of BOST seem to have been shelved. Although the Ghanaian tax payer invests heavily into the operations of the entity in developing storage facilities, the storage tanks are left dry. BOST have failed over the past years to store the mandatory fuel stock, seen as one of the key mechanisms to manage any oil supply disturbances and price shocks from the global market.

Written by Paa Kwasi Anamua Sakyi, Institute for Energy Security (IES) ©2019

The writer has over 22 years of experience in the technical and management areas of Oil and Gas Management, Banking and Finance, and Mechanical Engineering; working in both the Gold Mining and Oil sector. He is currently working as an Oil Trader, Consultant, and Policy Analyst in the global energy sector. He serves as a resource to many global energy research firms, including Argus Media and the CNBC Africa.

Top of Form