The Chief Executive of Tullow Oil Plc and exploration director have resigned, sparking a precipitous fall in share price as the firm cut its prediction for how much oil it will produce over the coming years.

Tullow’s shares fell 60 percent following announcement by Mr Paul McDade and Angus McCoss, that they had quit the firm.

The board said it was “disappointed by the performance of Tullow’s business”.

More than £1.05bn had been wiped off Tullow’s market value at 9am on Monday morning, leaving the company reeling, valued at £801.7m.

The firm has suspended its dividend to shareholders, and “now needs time to complete its thorough review of operations”.

Tullow shares have been under pressure since a steep fall last month, when it cut its production guidance for this year.

Dorothy Thompson, the company’s chair, said: “Despite today’s announcement, the board strongly believes that Tullow has good assets and excellent people capable of delivering value for shareholders.

“We are taking decisive action to restore performance, reduce our cost base and deliver sustainable free cash flow.”

Thompson has temporarily been installed as executive chair, as the firm kicks off its search for a new chief executive.

In July, Tullow reported that its production well at TEN in Ghana had been suspended, which then also postponed the completion of the site’s water injector well.

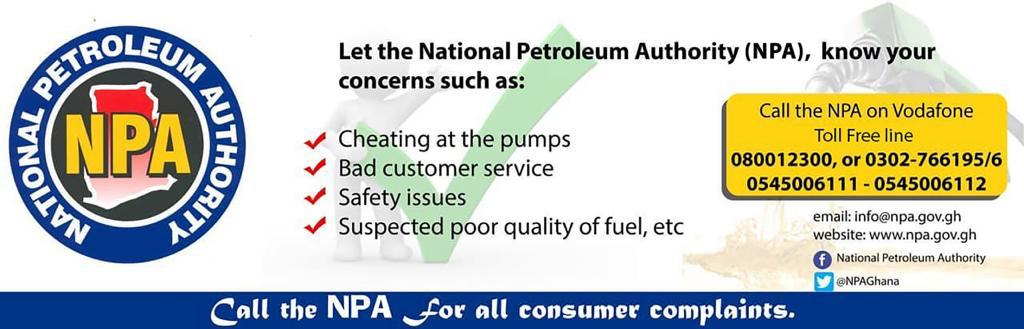

In addition to the reduction in production, export from the Ghana fields has been low due to a lack of demand from the Ghana national petroleum company.

The company said it expects full-year net production to average around 87,000 barrels of oil per day, reiterating its guidance from last month’s trading statement.

It also hopes for free cash flow of about $350m (£265.7m). It assured investors it has liquidity headroom of more than $1bn and no debt maturities approaching imminently.

However, Tullow said that after a review of “production performance issues” this year, and the impact this could have on its fields’ performance in the coming years, it had changed its guidance.

Next year’s production is predicted to average between 70,000 and 80,000 barrels of oil per day (bopd), while over the next three years it expects an average of 70,000 bopd.

Tullow said it had picked out “a number of factors” that have caused the reduction in guidance.

“Whilst financial performance has been solid, production performance has been significantly below expectations from the group’s main producing assets, the TEN and Jubilee fields in Ghana,” it said.