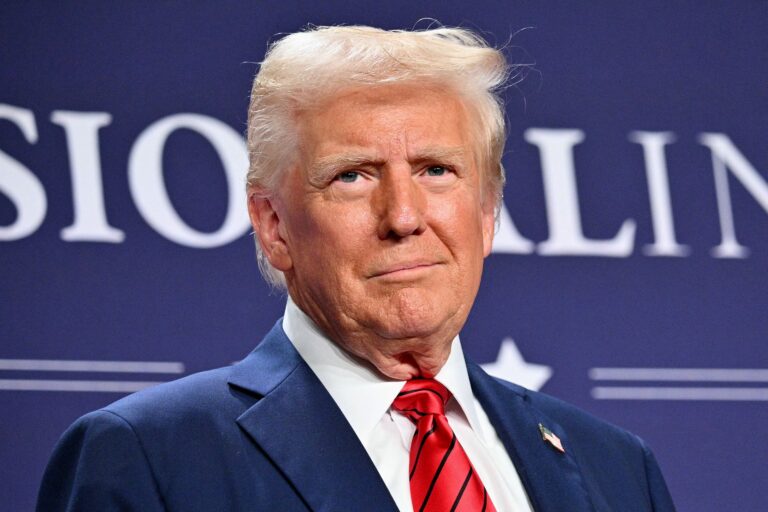

As U.S. President Donald Trump touted “the largest trade deal in history” with Japan, he also noted that the United States and Japan are set to conclude another deal to form a joint venture for LNG in Alaska.

“We concluded the one deal … and now we’re going to conclude another one because they’re forming a joint venture with us at, in Alaska, as you know, for the LNG,” President Trump said in comments on the deal to GOP lawmakers at the White House. “They’re all set to make that deal now,” the president added. The U.S. has completed what President Trump touted on Truth Social as “a massive Deal with Japan, perhaps the largest Deal ever made.” Under the trade agreement, Japan’s goods imported in the United States will face a 15% tariff, lower than the 24% proposed in early April and the 25% tariff President Trump proposed earlier this month with effect from August 1. The trade deal now calls for a 15% tariff on Japanese goods imported in the United States. However, President Trump’s additional remarks and assurances that the U.S. and Japan will conclude a joint venture deal for LNG in Alaska was not immediately confirmed by Japan. A Japanese government official at the Ministry of Economy, Trade and Industry (METI) told Reuters that the ministry is working to confirm President Trump’s comments. Japanese companies have been considering investments in the $44-billion Alaska LNG project, but so far they have appeared to be concerned that the costs may be too high, considering the cold weather in Alaska and the scale of the pipelines needed to bring the project on stream. Last week, reports emerged that India’s state-controlled natural gas firm GAIL (India) Ltd has started discussions about buying liquefied natural gas from the proposed Alaska LNG project. Energy companies are ready to commit to buying $115 billion worth of LNG from Alaska once President Trump’s pet energy project gets done, the company in charge of the project, Glenfarne, said last month, noting that as many as 50 companies have expressed formal interest. Source: Oilprice.comGhana: Tema Oil Refinery Gets New Board

Ghana’s President, John Dramani Mahama, has appointed nine members as Board of Directors for Ghana’s premier oil refinery – Tema Oil Refinery (TOR).

The new board is chaired by Hon. Nayon Bilijo. Other members of the reconstituted board are Edmond Kombat Esq.(Ag. Managing Director), Mr. Thomas Martey Laari, Mr. Robert Kempes Ofosuhene (former Mayor of Tema), and Hon. Dr. Sebastian N. Sandaare.

The rest are Mr. Mugabe Salifu Maase, Hon. Mohammed Issah Bataglia, Osabarima Kyei Osafo Kantanka and Mr. Ben Nunoo Mensah.

The new board was inaugurated at the Ministry of Energy and Green Transition at a brief ceremony.

The Energy Minister, Mr John Abdulai Jinapor, on behalf of President John Mahama, reminded the board about the critical role TOR plays in ensuring national energy security.

He charged the board with the urgent responsibility of restoring the refinery to full operational capacity.

“Your foremost duty is to get TOR back on stream,” the minister emphasised.

“You must implement bold and strategic actions to return the refinery to profitability. TOR is not just another company; it is a vital national asset,” he added.

The newly appointed Board Chairman, Hon. Nayon Bilijo, expressed appreciation to the President for the confidence reposed in them.

Speaking on behalf of his colleagues, he pledged the commitment of the board to restoring the operations of the refinery in line with government policy and national energy needs.

“We are honoured by this appointment and understand the enormity of the task ahead. We will work with urgency and dedication to revive TOR and make it a viable and efficient institution once more,” he assured Ghanaians.

“Your foremost duty is to get TOR back on stream,” the minister emphasised.

“You must implement bold and strategic actions to return the refinery to profitability. TOR is not just another company; it is a vital national asset,” he added.

The newly appointed Board Chairman, Hon. Nayon Bilijo, expressed appreciation to the President for the confidence reposed in them.

Speaking on behalf of his colleagues, he pledged the commitment of the board to restoring the operations of the refinery in line with government policy and national energy needs.

“We are honoured by this appointment and understand the enormity of the task ahead. We will work with urgency and dedication to revive TOR and make it a viable and efficient institution once more,” he assured Ghanaians.

The board is expected to quickly develop and submit a comprehensive roadmap that addresses the operational challenges of the refinery and lays out a sustainable strategy for the future.

Even before the board assumes post, this portal knows that clean air is blowing as the new managing director is seriously working around to restore the refinery to its former glory.

The board is expected to quickly develop and submit a comprehensive roadmap that addresses the operational challenges of the refinery and lays out a sustainable strategy for the future.

Even before the board assumes post, this portal knows that clean air is blowing as the new managing director is seriously working around to restore the refinery to its former glory.

“We are really happy about the progress of the work done so far. The MD is seriously working,” one of the refinery workers, who has worked in the refinery for more than twenty years, said.

During the previous administration, TOR had six managing directors. Unfortunately, the refinery’s turnaround could not materialise.

Source: https://energynewsafrica.com

“We are really happy about the progress of the work done so far. The MD is seriously working,” one of the refinery workers, who has worked in the refinery for more than twenty years, said.

During the previous administration, TOR had six managing directors. Unfortunately, the refinery’s turnaround could not materialise.

Source: https://energynewsafrica.com

“Your foremost duty is to get TOR back on stream,” the minister emphasised.

“You must implement bold and strategic actions to return the refinery to profitability. TOR is not just another company; it is a vital national asset,” he added.

The newly appointed Board Chairman, Hon. Nayon Bilijo, expressed appreciation to the President for the confidence reposed in them.

Speaking on behalf of his colleagues, he pledged the commitment of the board to restoring the operations of the refinery in line with government policy and national energy needs.

“We are honoured by this appointment and understand the enormity of the task ahead. We will work with urgency and dedication to revive TOR and make it a viable and efficient institution once more,” he assured Ghanaians.

“Your foremost duty is to get TOR back on stream,” the minister emphasised.

“You must implement bold and strategic actions to return the refinery to profitability. TOR is not just another company; it is a vital national asset,” he added.

The newly appointed Board Chairman, Hon. Nayon Bilijo, expressed appreciation to the President for the confidence reposed in them.

Speaking on behalf of his colleagues, he pledged the commitment of the board to restoring the operations of the refinery in line with government policy and national energy needs.

“We are honoured by this appointment and understand the enormity of the task ahead. We will work with urgency and dedication to revive TOR and make it a viable and efficient institution once more,” he assured Ghanaians.

The board is expected to quickly develop and submit a comprehensive roadmap that addresses the operational challenges of the refinery and lays out a sustainable strategy for the future.

Even before the board assumes post, this portal knows that clean air is blowing as the new managing director is seriously working around to restore the refinery to its former glory.

The board is expected to quickly develop and submit a comprehensive roadmap that addresses the operational challenges of the refinery and lays out a sustainable strategy for the future.

Even before the board assumes post, this portal knows that clean air is blowing as the new managing director is seriously working around to restore the refinery to its former glory.

“We are really happy about the progress of the work done so far. The MD is seriously working,” one of the refinery workers, who has worked in the refinery for more than twenty years, said.

During the previous administration, TOR had six managing directors. Unfortunately, the refinery’s turnaround could not materialise.

Source: https://energynewsafrica.com

“We are really happy about the progress of the work done so far. The MD is seriously working,” one of the refinery workers, who has worked in the refinery for more than twenty years, said.

During the previous administration, TOR had six managing directors. Unfortunately, the refinery’s turnaround could not materialise.

Source: https://energynewsafrica.com Uganda: EACOP Progresses As Construction Works Hit 64%

The East African Crude Oil Pipeline (EACOP) project, which stretches from Hoima in Uganda through to Chongoleani in Tanga, Tanzania, has reached a significant milestone with 64.5 percent of the work completed so far.

Briefing journalists on the progress of work recently, the Tanzania EACOP Project Coordinator, Asiad Mrutu, said they have reached the stage of constructing specialized storage tanks in Chongoleani, Tanga, which are intended to receive crude oil from Uganda.

Mrutu further noted that a substantial portion of the pipeline construction work between Hoima and Tanga has already been completed, marking a major achievement in the project’s implementation.

He added that the ongoing site inspections aim to monitor the progress made and ensure that the work continues efficiently and meets the required quality standards.

The project is expected to significantly boost Tanzania’s economy and contribute to the overall development of the East African region.

The EACOP project is one of the major strategic initiatives jointly implemented by Tanzania and Uganda.

It is designed to enhance the region’s competitiveness in the global market through the safe and reliable transportation of crude oil.

Source: https://energynewsafrica.com

Ghana: Former NPA CEO, Others Appear In Court Over Gh¢280M Extortion Claims; Granted Gh¢2 Million Bail Each

The former Chief Executive Officer of National Petroleum Authority (NPA), Dr. Mustapha Abdul-Hamid, and nine others, including three companies, accused of their alleged involvement in extortion and money laundering within the NPA, have appeared before the Criminal Division 3 of the High Court in Accra on Wednesday, July 23, 2025.

Sources at the court said the accused persons, who were present with their lawyers, were granted Gh¢2 million bail each.

The Office of the Special Prosecutor (OSP), an independent anti-corruption agency in Ghana, charged them for allegedly using their official positions to orchestrate a scheme that unlawfully diverted funds from petroleum transporters and oil marketing companies between 2022 and December 2024, which Dr. Mustapha Abdul-Hamid vehemently denied.

Dr. Abdul-Hamid, who is the first accused in the case, alongside Jacob Kwamena Amuah, Coordinator of the Unified Petroleum Pricing Fund, and Wendy Newman, an NPA employee, are required to produce two sureties each, both of whom must earn a net monthly salary of not less than GH¢5,000, with their salaries to be justified.

Additionally, they are also to report to the OSP every two weeks as investigations continue.

They have all pleaded not guilty to charges including conspiracy to commit extortion, extortion by a public officer, use of public office for profit, and money laundering.

The court also granted bail to four additional individuals—Albert Ankrah, Isaac Mensah, Bright Bediako-Mensah, and Kwaku Aboagye Acquah—who face similar charges. Each was granted GH¢2 million bail, but with three sureties, including one backed by landed property. They too must report to the OSP biweekly.

The remaining accused persons—yet to be named—include corporate entities allegedly involved in the grand scheme of corruption and financial misconduct within the petroleum sector between 2022 and 2024.

According to prosecutors, the accused allegedly operated an elaborate scheme targeting Oil Marketing Companies (OMCs) and Bulk Oil Distribution Companies (BDCs), using their public office to extort funds. Investigations suggest that proceeds from the scheme were laundered into real estate, luxury vehicles, and fuel stations.

Source: https://energynewsafrica.com

UK: Bp Agrees To Sell US Onshore Wind Business To LS Power

Bp has announced that it has agreed to sell its US onshore wind business, BP Wind Energy North America Inc. (bp Wind Energy), to LS Power, a leading development, investment, and operating company focused on the North American power and energy infrastructure sector.

According to Bp, the transaction will be concluded by the end of the year, subject to regulatory approvals. This is the latest example of bp’s $20 billion divestment program to simplify and focus the business.

After the close of the transaction, bp Wind Energy will be owned and operated as part of LS Power’s portfolio company Clearlight Energy, increasing its operating fleet to approximately 4.3 GW.

Bp Wind Energy has been marketed as an integrated business, with its experienced workforce expected to transfer to the new owner upon completion of the deal.

The business has interests in 10 operating onshore wind energy assets across seven US states, operating nine of them.

The deal is part of bp’s focus on its low-carbon energy portfolio, prioritizing investment choices while delivering value for shareholders.

William Lin, bp EVP for Gas & Low Carbon Energy, said, “We have been clear that while low-carbon energy has a role to play in a simpler, more focused bp, we will continue to rationalize and optimize our portfolio to generate value.

The onshore US wind business has great assets and fantastic people, but we have concluded we are no longer the best owners to take it forward. I am pleased we have reached a mutually beneficial deal with LS Power, and I look forward to working with them to support our people in maintaining safe and reliable operations as we transition ownership.”

LS Power will add bp’s US onshore wind business to an existing fleet of renewable, energy storage, flexible gas, and renewable fuels assets, which comprise a 21 GW operating portfolio and more than 780 miles of high-voltage transmission lines in operation, as well as another 350+ miles currently under construction or development.

Paul Segal, CEO of LS Power, said, “We are focused on a holistic approach to advancing American energy infrastructure that includes improving existing energy assets while investing in transformative strategies that make energy more efficient, affordable, and available. Well-located with well-structured contracts, these new assets will expand our renewable energy presence and help meet growing energy demand across the US. We look forward to welcoming the talented teams operating these assets to LS Power and partnering with them to drive value for our stakeholders.”

In its Q1 2025 results, bp updated its divestment guidance for 2025 to $3-4 billion, with $1.5 billion signed or completed as of that date.

Source:https://energynewsafrica.com

Tanzania: AfDB Approves $282 Million To Expand Clean Energy Access In Island Regions

The African Development Bank (AfDB) Group has approved $282.07 million to support the installation of high and medium voltage submarine power cables to Zanzibar (Unguja and Pemba) and Mafia Islands.

The initiative aims to significantly enhance access to clean, reliable electricity and expand the adoption of clean cooking solutions in Tanzania.

The five-year project is expected to increase available power capacity on the three Islands from 143 MW to 440 MW.

It will also support last-mile electricity connections for 465,000 people and facilitate the distribution of electric cooking appliances to benefit 335,300 Tanzanians.

This investment aligns with Tanzania’s goal to achieve 75 percent electricity access and clean cooking adoption by 2030, in line with its commitments under Mission 300 – a joint initiative of the African Development Bank Group and the World Bank aimed at mobilizing resources to connect 300 million Africans to electricity by 2030.

Currently, Tanzania’s average electricity access rate stands at 46 percent, while approximately 90 percent of the population still relies on traditional biomass fuels such as firewood and charcoal for cooking.

The project is expected to generate employment during the implementation and operational phases. It will particularly benefit women and youth, spurring entrepreneurship in sectors such as retail, hospitality, transportation, digital enterprises, and personal care services.

“Expanding electricity access in the country will boost youth-led MSMEs across various industries, generating a multiplier effect on job creation, while the adoption of clean cooking solutions will significantly improve the quality of life for women and girls at home by promoting alternative fuels and efficient clean cooking technologies,” said Patricia Laverley, African Development Bank Country Manager for Tanzania.

The project is also vital to the development of Zanzibar’s tourism sector, which contributes approximately 30 percent of the island’s GDP.

Source: https://energynewsafrica.com

Algeria: SONATRACH, SINOPEC Sign Heads Of Agreement

Algeria’s national oil company, SONATRACH, and its Chinese partner, SINOPEC, have signed a Heads of Agreement aimed at outlining the framework of cooperation between the parties to assess and develop hydrocarbon resources in the Gourara and East Berkine basins.

By signing this Heads of Agreement, the parties express their willingness to bolster their existing relationship and expand their cooperation through new partnership opportunities in hydrocarbon exploration and development.

The parties will discuss the work program to agree on the evaluation and exploitation of these resources, integrating best practices for environmental preservation and responsible exploitation of natural resources.

Source: https://energynewsafrica.com

Egypt: United Energy Signs 20MWp Hybrid Solar Deal With LONGi For Oilfield Decarbonization

Egypt-based United Energy has signed a Memorandum of Understanding (MoU) with LONGi Green Energy, a global leader in solar technology, to deploy a 20-megawatt (MW) hybrid solar power system across six oil fields.

The project is expected to deliver 24,800 megawatt-hours (MWh) of annual clean energy, powering more than 6,000 Egyptian households, while avoiding over 14,000 tons of carbon dioxide emissions yearly, equivalent to removing approximately 3,000 gasoline vehicles.

“This partnership with LONGi marks a pivotal moment in our journey to redefine how energy is produced in the oil and gas sector,” said Kamel Al Sawi, President of United Energy Egypt.

“By deploying cutting-edge solar and storage technologies, we are not only reducing emissions but also setting a new regional benchmark for what is possible in industrial decarbonization.”

This project marks North Africa’s first large-scale application of Back Contact technology with LONGi’s proprietary HPBC 2.0 cells. Back Contact refers to a solar cell design where all electrical contacts are placed on the back of the cell, improving aesthetics, reducing shading, and boosting efficiency in harsh environments.

“This project exemplifies how solar innovation can transform even the most energy-intensive industries,” said Felix Wu, Sales Director at LONGi MEA&CA, Africa.

“By combining our BC technology with hybrid systems, we are helping UEE achieve ESG goals while bolstering Egypt’s renewable leadership.”

The project integrates LONGi’s Hi-MO 9 modules with 24.43% high efficiency performance in the desert environment.

The modules also contain a battery energy storage system (BESS) and diesel generators, aiming to cut diesel use by more than 70%.

Source: https://energynewsafrica.com

This project marks North Africa’s first large-scale application of Back Contact technology with LONGi’s proprietary HPBC 2.0 cells. Back Contact refers to a solar cell design where all electrical contacts are placed on the back of the cell, improving aesthetics, reducing shading, and boosting efficiency in harsh environments.

“This project exemplifies how solar innovation can transform even the most energy-intensive industries,” said Felix Wu, Sales Director at LONGi MEA&CA, Africa.

“By combining our BC technology with hybrid systems, we are helping UEE achieve ESG goals while bolstering Egypt’s renewable leadership.”

The project integrates LONGi’s Hi-MO 9 modules with 24.43% high efficiency performance in the desert environment.

The modules also contain a battery energy storage system (BESS) and diesel generators, aiming to cut diesel use by more than 70%.

Source: https://energynewsafrica.com

This project marks North Africa’s first large-scale application of Back Contact technology with LONGi’s proprietary HPBC 2.0 cells. Back Contact refers to a solar cell design where all electrical contacts are placed on the back of the cell, improving aesthetics, reducing shading, and boosting efficiency in harsh environments.

“This project exemplifies how solar innovation can transform even the most energy-intensive industries,” said Felix Wu, Sales Director at LONGi MEA&CA, Africa.

“By combining our BC technology with hybrid systems, we are helping UEE achieve ESG goals while bolstering Egypt’s renewable leadership.”

The project integrates LONGi’s Hi-MO 9 modules with 24.43% high efficiency performance in the desert environment.

The modules also contain a battery energy storage system (BESS) and diesel generators, aiming to cut diesel use by more than 70%.

Source: https://energynewsafrica.com

This project marks North Africa’s first large-scale application of Back Contact technology with LONGi’s proprietary HPBC 2.0 cells. Back Contact refers to a solar cell design where all electrical contacts are placed on the back of the cell, improving aesthetics, reducing shading, and boosting efficiency in harsh environments.

“This project exemplifies how solar innovation can transform even the most energy-intensive industries,” said Felix Wu, Sales Director at LONGi MEA&CA, Africa.

“By combining our BC technology with hybrid systems, we are helping UEE achieve ESG goals while bolstering Egypt’s renewable leadership.”

The project integrates LONGi’s Hi-MO 9 modules with 24.43% high efficiency performance in the desert environment.

The modules also contain a battery energy storage system (BESS) and diesel generators, aiming to cut diesel use by more than 70%.

Source: https://energynewsafrica.com Ghana: PURC Retrieves GH¢4 Million For ECG In Greater Accra Region In First Half Of 2025

The Public Utilities Regulatory Commission (PURC) has recovered over GH¢4 million for the Electricity Company of Ghana (ECG) in the first half of 2025 through customer complaint interventions.

According to a report by Ghana News Agency, the commission received 700 complaints between January and June in the Greater Accra Region.

Out of the figure, the PURC resolved 689, representing 98%.

These resolutions resulted in payments totaling GH¢4,295,445.64 to ECG and GH¢173,986.60 to customers.

The Greater Accra Regional Manager of PURC, Madam Gifty Bruce-Nelson, said a combined GH¢4,469,432.25 was disbursed to utility providers and consumers to promote sustainability and satisfaction.

“Quality of service tops the list of complaints, with 450 complaints where customers have challenges including frequent outages, faulty transformers, broken poles, and low water pressure, among others,” she said.

Madam Bruce-Nelson noted that complaints also included billing discrepancies, malfunctioning meters, and property damage due to outages. Most reports were submitted electronically (406), with others via phone (117), walk-ins (56), written submissions (53), toll-free calls (21), and field visits (4).

Compared to the same period in 2024, 804 complaints were made, with 233 electronic submissions. That year, ECG recovered GH¢11,441,875.55, and customers received GH¢552,972.69 through PURC’s efforts.

In her mid-year briefing is likely an error since the period under review is Q1, Madam Bruce-Nelson indicated that 555 complaints (79%) were against ECG, 109 (16%) against Ghana Water Company Limited (GWCL), and 36 (5%) against other utility providers or matters. She said the Commission had intensified public education efforts, conducted 20 visits to ECG service centers, and engaged in community, prepaid, and industrial monitoring.

“Power supply in all the communities visited was quite stable except for the Volo community, which complained of frequent power outages, which sometimes last for two days before power is restored,” she noted.

Source: https://energynewsafrica.com

Global Gas Flaring Hits Highest Level Since 2007, Undermining Energy Security And Emissions Goals

Global gas flaring surged for a second year in a row, wasting about $63 billion in lost energy and setting back efforts to manage emissions and boost energy security and access.

Flaring, the practice of burning natural gas during oil extraction, reached 151 billion cubic meters (bcm) in 2024, up 3 bcm from the previous year and the highest level in almost two decades. An estimated 389 million tonnes of CO₂ equivalent—46 million of that from unburnt methane, one of the most potent greenhouse gases—was needlessly emitted.

While some countries have reduced flaring, the top nine largest-flaring countries continue to account for three-quarters of all flaring, but less than half of global oil production.

Satellite data compiled and analyzed in the World Bank’s annual Global Gas Flaring Tracker shows that flaring intensity—the amount of gas flared per barrel of oil produced—has remained stubbornly high for the last 15 years.

“When more than a billion people still don’t have access to reliable energy and numerous countries are seeking more sources of energy to meet higher demand, it’s very frustrating to see this natural resource wasted,” said Demetrios Papathanasiou, World Bank Global Director for Energy and Extractives.

The report highlights that countries committed to the Zero Routine Flaring by 2030 (ZRF) initiative have performed significantly better than countries that have not made the commitment. Since 2012, countries that endorsed ZRF achieved an average 12% reduction in flaring intensity, whereas those that did not saw a 25% increase.

To accelerate progress, the World Bank’s Global Flaring and Methane Reduction (GFMR) Partnership is supporting methane and flaring reduction projects through catalytic grants, technical assistance, policy and regulatory reform advisory services, capacity building, and institutional strengthening.

For example, in Uzbekistan, GFMR allocated $11 million to identify and fix methane leaks in the gas transportation network, cutting methane emissions by 9,000 tonnes annually, and potentially reaching up to 100,000 tonnes each year.

“Governments and operators must make flaring reduction a priority, or this practice will persist. The solutions exist. With effective policies we can create favorable conditions that incentivize flaring reduction projects and lead to sustainable, scalable action. We should turn this wasted gas into an engine for economic development.” said Zubin Bamji, World Bank Manager for the Global Flaring & Methane Reduction (GFMR) Partnership.

Source: https://energynewsafrica.com/World Bank

Ghana: Beyond PPA Renegotiations And Tariff Tweaks: A Review Of The Minority’s D-Levy Alternatives

By: Albert Neenyi Ayirebi-Acquah

Ghana’s energy sector has been assessed by the IMF as posing the greatest fiscal risk to the economy given the significant debt buildup and the impact of supply disruptions to growth and revenue projections for the budget.

This is not new. Ghana’s energy sector has an item on our economic to-do list since 2012 and been caught up in many heated political debates since 2014. The debate persists following the NPP’s departure on January 7, after eight years in charge of the sector.

This article examines the policy alternatives proposed by the Minority, who urge the new government to refrain from implementing the D-levy – intended to enhance liquidity for electricity supply – and instead continue with the renegotiation of Power Purchase Agreements (PPAs) that they previously initiated among other measures.

1. What has been the Minority’s track record?

During their tenure, the Minority announced several successful PPA renegotiations with savings to the budget which are summarised in the table (Fig. 1) below. With these successful renegotiations, and their announced savings, one wonders which specific contracts remain to be renegotiated which the Minority expects the current government to complete and why these are not being mentioned.

2. Energy subsidies have continued to rise despite past government claims of PPA savings.

Second, below is a summary of the cost of subsidies to the budget between 2022 and 2029. One wonders why the announced savings by the then NPP government are not reflecting in the costs of subsidy to the budget, especially the doubling of subsidies in 2023, the year in which the parliamentary committee on energy announced significant savings on excess capacity and renegotiation of PPAs to Take and Pay.

For example, in 2021, in a press briefing by the former Energy Minister, Dr. Mathew Opoku-Prempeh, he claimed savings of $1.4 billion per annum following renegotiated PPA contracts.

Based on this, what accounts for the quadrupling of energy sector subsidies in 2023 compared to 2022 and which stay significant until 2028 when they begin to reduce? Where is the impact of these savings?

2. Energy subsidies have continued to rise despite past government claims of PPA savings.

Second, below is a summary of the cost of subsidies to the budget between 2022 and 2029. One wonders why the announced savings by the then NPP government are not reflecting in the costs of subsidy to the budget, especially the doubling of subsidies in 2023, the year in which the parliamentary committee on energy announced significant savings on excess capacity and renegotiation of PPAs to Take and Pay.

For example, in 2021, in a press briefing by the former Energy Minister, Dr. Mathew Opoku-Prempeh, he claimed savings of $1.4 billion per annum following renegotiated PPA contracts.

Based on this, what accounts for the quadrupling of energy sector subsidies in 2023 compared to 2022 and which stay significant until 2028 when they begin to reduce? Where is the impact of these savings?

3. What alternative proposals have been presented by the Minority, according to these sources?

3. What alternative proposals have been presented by the Minority, according to these sources?

Based on the above, the Minority NPP have proposed the following:

Based on the above, the Minority NPP have proposed the following:

2. Energy subsidies have continued to rise despite past government claims of PPA savings.

Second, below is a summary of the cost of subsidies to the budget between 2022 and 2029. One wonders why the announced savings by the then NPP government are not reflecting in the costs of subsidy to the budget, especially the doubling of subsidies in 2023, the year in which the parliamentary committee on energy announced significant savings on excess capacity and renegotiation of PPAs to Take and Pay.

For example, in 2021, in a press briefing by the former Energy Minister, Dr. Mathew Opoku-Prempeh, he claimed savings of $1.4 billion per annum following renegotiated PPA contracts.

Based on this, what accounts for the quadrupling of energy sector subsidies in 2023 compared to 2022 and which stay significant until 2028 when they begin to reduce? Where is the impact of these savings?

2. Energy subsidies have continued to rise despite past government claims of PPA savings.

Second, below is a summary of the cost of subsidies to the budget between 2022 and 2029. One wonders why the announced savings by the then NPP government are not reflecting in the costs of subsidy to the budget, especially the doubling of subsidies in 2023, the year in which the parliamentary committee on energy announced significant savings on excess capacity and renegotiation of PPAs to Take and Pay.

For example, in 2021, in a press briefing by the former Energy Minister, Dr. Mathew Opoku-Prempeh, he claimed savings of $1.4 billion per annum following renegotiated PPA contracts.

Based on this, what accounts for the quadrupling of energy sector subsidies in 2023 compared to 2022 and which stay significant until 2028 when they begin to reduce? Where is the impact of these savings?

3. What alternative proposals have been presented by the Minority, according to these sources?

3. What alternative proposals have been presented by the Minority, according to these sources?

Based on the above, the Minority NPP have proposed the following:

Based on the above, the Minority NPP have proposed the following:

- Renegotiating Power Purchase Agreements

- Making ECG more operationally efficient

- Financing the cost of power through the PURC tariff

- Increasing the contribution of Renewable Energy in our generation mix

Ghana: Accra Mayor Hints At Electric Metro Bus Initiative With US Electric Buses Manufacturer

The Mayor of Accra, Michael Kpakpo Allotey, has hinted at plans to introduce electric-powered Metro Mass Transit buses in the capital through a strategic partnership with investors from Savannah, Georgia, in the United States.

The Mayor made this known on Friday, July 18, 2025, during a courtesy call by a delegation from the City of Savannah, led by its Mayor, Van R. Johnson II, to Accra as part of his official tour of Ghana.

Mayor Allotey told journalists that discussions were already underway to explore opportunities for investment in electric buses, which he said would provide a more sustainable and cost-effective transportation alternative for residents of Accra.

“It is my dream to have more electric buses in Accra, and we have discussed it. We are going to get electric buses in Accra, which will offer cheaper fares, benefiting both the environment and commuters. The novelty of these buses will attract many users, and the initiative will also create numerous job opportunities,” he said.

He disclosed that Mayor Johnson had mentioned a connection with a company based in Savannah that manufactures electric buses, specifically referencing a potential link with Hyundai, and assured him of efforts to initiate talks for possible collaboration.

Source: https://energynewsafrica.com

UK: BP Appoints Albert Manifold As Board Chairman

UK-based oil and gas giant BP plc has appointed Albert Manifold as chair of the company. He will join the company’s board on September 1 as a non-executive director and assume the position of Chair on October 1, 2025, according to a statement issued by BP on Monday.

He takes over from Helge Lund, who is leaving the company after meritorious service.

Albert was the Chief Executive Officer of CRH plc (“CRH”) from January 2014 until December 2024.

Under his leadership, CRH strategically reshaped its portfolio and delivered superior growth and performance.

He has a strong track record of strategic leadership and operational delivery, with a focus on cost efficiency, disciplined capital allocation, and cash flow generation.

He is also a non-executive director at LyondellBasell, a global chemicals producer listed on the New York Stock Exchange, and a non-executive director at Mercury Engineering, a leading privately-owned engineering consultancy.

Dame Amanda Blanc, BP’s senior independent director, who led the succession process on behalf of the board, said: “I am delighted that, following a rigorous and comprehensive global search, we have been able to appoint Albert as our new chair. His impressive track record of shareholder value creation at CRH demonstrates he is the ideal candidate to oversee BP’s next chapter.

“Albert has a relentless focus on performance, which is well-suited to BP’s needs now and into the future. He transformed and refocused CRH into a global leader by building on its rich heritage to deliver superior growth, cash generation, and returns.

“On behalf of the company, I would also like to thank Helge for his leadership and dedicated service to BP throughout the past seven years. His contribution through a period of immense change has been invaluable.”

Albert Manifold said: “It is an honor to be appointed chair of one of the world’s great energy companies and to have the opportunity to help the company reach its full potential. BP has a vital role to play in addressing the world’s growing energy needs. I look forward to working with the BP board, Murray, and the leadership team to accelerate delivery of BP’s strategy and drive compelling and sustainable shareholder value creation.”

Albert is a Certified Public Accountant, a Chartered Accountant, and holds a Master of Business Administration and a Master in Business Studies, both from Dublin City University.

He remains a special adviser to the board of CRH and is also an adviser at Clayton Dubilier & Rice.

Source: https://energynewsafrica.com

Ghana: GOIL Announces Upgrade Of 270 Retail Stations By December

The Group Chief Executive Officer and Managing Director of GOIL PLC, Edward Abambire Bawa, revealed that the company plans a nationwide renovation of 200 GOIL fuel stations by December 2025 as part of its broader modernization strategy.

Thirty out of the 50 dealer-managed outlets would be refurbished into modern pump stations.

He announced this at a dealer engagement forum in the Western Region last week.

“This initiative goes beyond aesthetics,” he explained. “It’s about ensuring our stations are fully equipped, attractive, and capable of offering world-class services at competitive prices.”

Mr. Bawa also hinted at current engagements with the Presidency to secure additional petroleum supply volumes. According to him, this is aimed at ensuring more affordable and steady fuel delivery across the country.

The state-owned company is also positioning itself to boost operational efficiency by rolling out a digital platform to provide dealers with real-time access to their account balances and monthly statements.

“No more waiting for updates from middle-level staff—you’ll be able to log in and view your statement anytime,” he stated.

The firm’s digital transformation agenda, he pointed out, will span internal systems and customer interfaces, positioning GOIL as a modern, agile, and future-ready energy company.

“GOIL is not just a business—it’s a legacy. Together, we’ll build a company that is modern, trusted, and proudly Ghanaian.”

“There is light at the end of the tunnel,” Mr. Bawa concluded.

Source:https//energynewsafrica.com