The Association of Oil Marketing Companies (AOMCs) in the Republic of Ghana says it expected the government to take steps to address the issue of tax evasion in the country’s downstream petroleum sector instead of introducing new taxes on petroleum products.

A recent report by the Chamber of Bulk Oil Distributors (CBODs) revealed that Ghana lost GH₵1.9 billion to tax evasion in 2019.

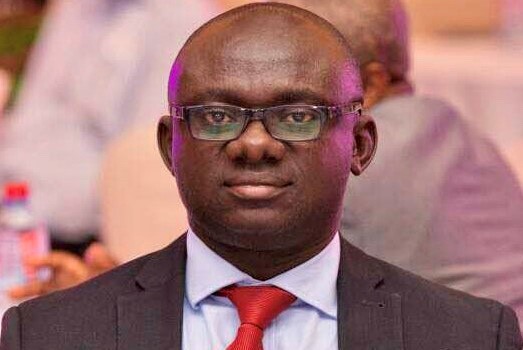

The Chairman of the Association of Oil Marketing Companies, Henry Akwaboah indicated that inasmuch as taxes are important, a lot more focus should be given to sealing the leakages.

“Every country needs taxes to develop the nation, and I am not averse to it. I rather want to support the government in collecting the taxes but the question we need to ask ourselves is, are we able to collect the current taxes in the price build-up such that there are no leakages anywhere and that every player in the industry is being made to collect these taxes on behalf of the government?

“We all know that some players are evading taxes in many ways.”

Ghana: Gov’t Won’t Hesitate To Deal With Saboteurs At TOR-Energy Minister

Commenting on how these tax evasions were impacting on the industry, Mr. Akwaboah said, “That also results in the price differentials you see on the market. So the government needs to zoom in and see if people are paying the taxes or not. We have heard about products coming into the country that do not go through the official channel. Who is looking after these? I would be happy to support any effort to clamp down on all these activities, so we need to look at it. Let’s look at it to see whether taxes really have to be increased if we are efficient at collecting what has been put on the prices today.”

Source:www.energynewsafrica.com