Russian oil and gas giant LUKOIL, has raised concerns about Norwegian oil and gas firm, Aker Energy’s decision to sell 37 percent stake in the DWT/CTP oil block offshore Republic of Ghana to the West African nation’s national oil company, GNPC.

Ghana’s GNPC is seeking acquisition of 37 percent stake in Deep Water Cape Three Points oil block operated by Aker Energy and 70 per cent in the South Deepwater Tano(SDWT) block operated by AGM.

It has, therefore, submitted a document to Ghana’s Parliament seeking approval to go for a loan facility of $1.65 billion to facilitate the acquisition of stakes in the two oil blocks.

However, the planned acquisition has generated wide spread criticisms with 15 civil society groups working in the extractive sector, good governance and anti corruption institutions raising concerns about the value of the deal.

While the ongoing controversy surrounding the deal is yet to settle, LUKOIL has expressed shocked over the deal.

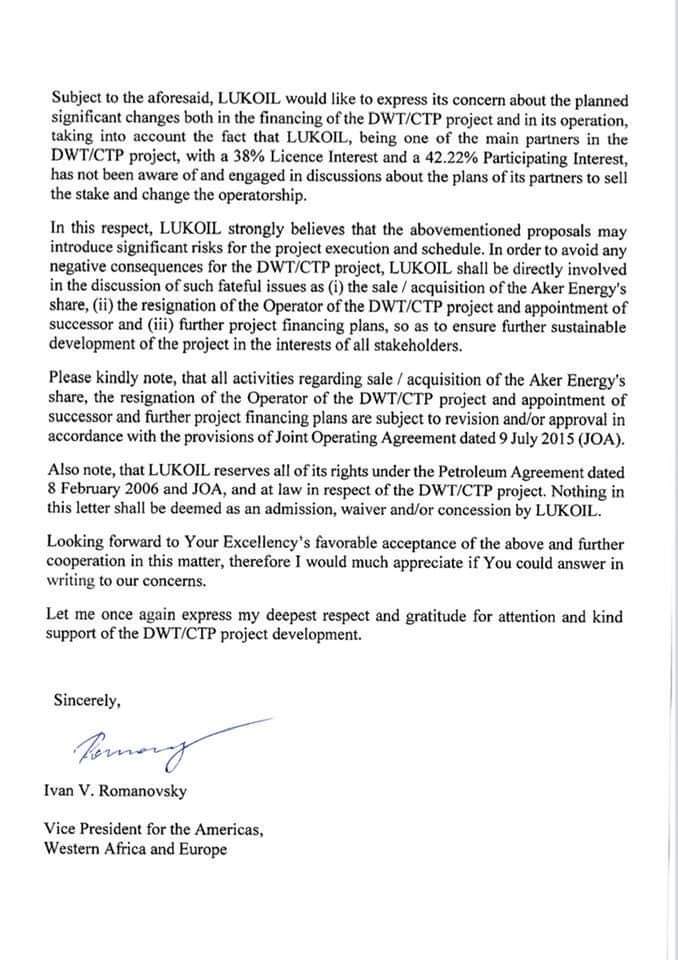

LUKOIL which holds 38% License Interest and a 42.22% Participating Interest in the Aker Energy block in a letter addressed to the Presidency and copied to the Ministry of Energy, Ministry of Finance, Aker Energy and the GNPC, said it was not aware of the planned deal until the Ghanaian media published stories about the deal after the country’s Energy Minister submitted a document to Parliament on behalf of GNPC.

LUKOIL asserts that the planned acquisition of the oil blocks poses significant risks to the project execution of the oil blocks adding that to avoid any negative consequences for the DWT/CTP project, LUKOIL going forward should be involved in the following;

(i) the sale/acquisition of Aker Energy’s share.

(ii) the resignation of the Operator of the DWT/CTP project and an appointment of a successor.

(iii) further project financing plans so as to ensure further sustainable development of the project in the interest of all stakeholders.