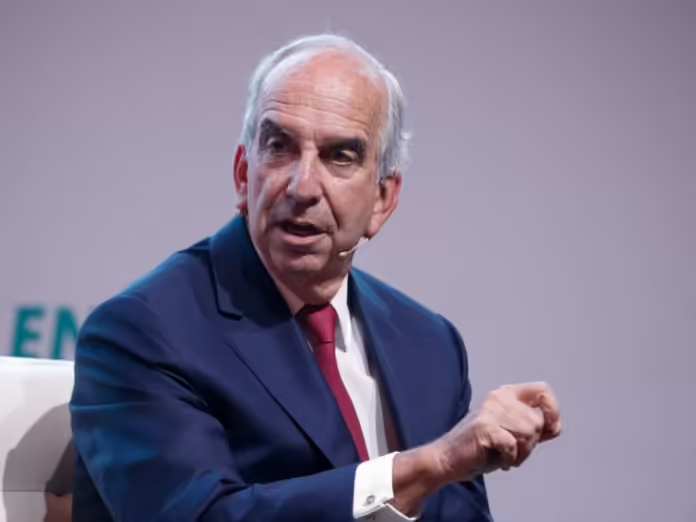

U.S. regulators will allow Chevron to move forward with its $53 billion acquisition of Hess but are barring Chief Executive Officer John Hess from joining the supermajor’s board, saying he improperly communicated with OPEC.

The U.S. Federal Trade Commission said in a statement Monday that Hess communicated with members of the group and its allies, encouraging them in some cases to stabilize oil production and draw down inventories.

“Mr. Hess’s communications with competitors about global oil output and other dimensions of crude oil market competition disqualify him from serving on Chevron’s Board of Directors,” said Henry Liu, Director of the FTC’s Bureau of Competition.

Chevron and Hess didn’t immediately comment. The FTC voted 3-2 in favor of the agreement.

The Hess family’s stake in the company founded by John Hess’ father almost a century ago is worth about $5 billion under the terms of the takeover agreement announced in October. Hess, 70, stands to become one of Chevron’s biggest shareholders upon closure of the deal.

The agreement marks the second time this year the FTC has barred a senior oil executive from joining a suitor company’s board.

The agency reached a settlement with Exxon Mobil Corp. in May that blocked Pioneer Natural Resources Co. Founder Scott Sheffield from obtaining a directorship, citing texts and emails that it claimed amounted to “collusive activity” with OPEC officials.

Sheffield has denied any wrongdoing, and accused the FTC of “publicly and unjustifiably vilifying” him.

For Chevron, the end of the antitrust review clears a key hurdle for the company’s biggest transaction since its 2001 acquisition of Texaco Inc.

To close the Hess deal, Chevron still needs to prevail in arbitration over claims of rights of first refusal by Exxon Mobil Corp. and Cnooc Ltd. to Hess’ most important asset — a 30% stake in a huge Guyanese oilfield.

The FTC conducted similar probes of Occidental Petroleum Corp.’s acquisition of Texas shale driller CrownRock LP, and Diamondback Energy Inc.’s purchase of Endeavor Energy Resources LP, opting in both cases against challenging the transactions.

The agency also declined to challenge Chesapeake Energy Corp.’s takeover of Southwestern Energy Co.

Source: World oil

Discover more from Energy News Africa

Subscribe to get the latest posts sent to your email.